How to use this guide

Updates are being announced hour to hour from the Department of Labor, the Department of Insurance, as well as the individual carriers with regulation updates pertaining to the COVID-19 pandemic. During such a stressful time in general, this can be quite overwhelming as a business owner.

Our team has accumulated the most up to date information and consolidated Frequently Asked Questions (FAQs). Below, please find some important information pertaining to these changes. In addition, you will find some excellent information in regards to the continuation of benefits, as well as the modified Family Leave Act, and how it now applies to small businesses.

Health Insurance Carrier COVID-19 Updates

Please select your current health carrier. Updated as of 3/31/2020

Original Source: Savoy Associates

COVID-19 Antibody Testing

All Commercial and Medicaid plans will cover serological (antibody) testing with no member cost-share, as required under recent legislation.

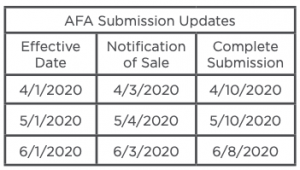

Small Group New Business Submission Extensions

Exceptions

Off Anniversary plan downgrades are available through July 31, 2020. Businesses that temporarily close will be allowed to continue their AFA plan provided premiums are paid monthly based on the assumption that the business will reopen after the COVID-19 pandemic. Business that close permanently Aetna will waive the 30-day advance termination requirement upon group request. Such a request must be received prior to the termination date. Special Enrollment period, Aetna has is offering a SEP for employees who previously waived coverage, the enrollment opportunity is being offered from April 6-17th for an April or May 1, 2020 effective date.

Furlough/Layoffs Special Rules

Furloughed (temporarily laid-off) employees and those with reduction in hours will be temporarily allowed to stay on the medical plan provided premium the option to remain insured is offered to all impacted employees. Employees who are terminated, should be terminated from the group health plan and offered State Continuation/COBRA. Upon rehire, wait period will be waived. These exceptions will expire on July 31, 2020.

Premium Grace Periods

Aetna will work with AFA plan sponsors to extend grace periods for the months of March, April and May. Group must contact the Answer Team to establish the extension. Fully-Insured NY Small Groups: Aetna will

not terminate any NY small employer group for non-payment of their health insurance premiums through

June 1, 2020. During the extended grace period, claims will continue to be paid and please know your small

group customers will not be sent to collections or to collection reporting agencies. Aetna is available to

discuss your payment and plan options, to do so call your broker or Aetna at 1-800-297-7145.

IN-Network Diagnostic Testing for COVID-19

Member Cost-Share Waived

Small Maintenance Medications

Waiving early refill limits on 30-day supply of maintenance medications. CVS waiving charges for home delivery of medications.

Telemedicine

Member cost-share waived,through 6/6/2020

Carrier Resources

https://www.aetna.com/individuals-families/member-rights-resources/need-to-know-coronavirus.html

COVID-19 Diagnostic & Antibody Testing

AmeriHealth will cover the cost for testing including antibody testing that is ordered by your physician or

state health department through December 31, 2020.

Small Group New Business Submission Extensions

Not applicable at this time

Exceptions

Prior authorization requirements are being waived for acute inpatient admissions from the emergency department for members with a COVID-19 diagnosis and for transfers from acute inpatient facilities to post-acute facilities.

Furlough/Layoffs Special Rules

AmeriHealth New Jersey will honor employer requests to continue coverage for employees furloughed or temporarily laid off as a result of impacts of COVID-19. This exception applies to fully-insured and self-funded business. This exception will not be valid on or after September 30, 2020. Contact your Sales Team for additional details.

Premium Grace Periods

Fully-Insured groups may elect to defer April or May premium payments. To be eligible, all premium payments must be current through March for an April deferral or through April for a May deferral. To apply for the deferral groups must submit a signed Deferred Premium Program Agreement. In addition, Large Group (51+) must provide an attestation from their senior financial officer or CPA stating that the group has experienced financial hardship caused by COVID-19. Please contact your Savoy sales team for further details. IMPORTANT DEADLINES: APRIL deferral requests must be submitted to Savoy in full by 4:00PM on Monday, April 20, 2020. May deferral requests must be submitted to Savoy by 4:00PM on May 15, 2020.

Testing & Treatment

Member cost share is being waived for in-network, inpatient, acute care treatment for COVID-10. In addition, member cost share is being waived for emergency room visits when a member is admitted for COVID-19 treatment. This means members will have no out of pocket costs for COVID-19 inpatient hospitalizations. These changes are in effect from March 30, 2020 through December 31, 2020.

Maintenance Medications

Waiving early refill limits on 30-day supply of maintenance medications expired June 30, 2020.

Telemedicine

Expanded telemedicine coverage allows members to have virtual visits with their regular doctors at no cost for all services, not just COVID-19 services through December 31, 2020.

Carrier Resources

COVID-19 Antibody Testing

Cigna will cover FDA-authorized COVID-19 diagnostic serology tests without cost-share when billed with CPT codes 86328 and 86769. As of April 22, 2020, there are four Emergency Use Authorized (EUA) FDA-approved serology tests that measure antibody levels for COVID-19. Cigna encourages providers to review the FDA website for the most up-to-date list of approved tests.

Cigna intends to reimburse these tests consistent with CMS pricing. However, CMS has not yet released pricing for these codes. Savoy will provide additional updates regarding reimbursement when this information becomes available. Claims submitted for these codes prior to the codes being priced and added to Cigna’s claims system may be held to ensure proper processing and reimbursement.

Small Group New Business Submission Extensions

Not applicable at this time

Exceptions

Not applicable at this time

Furlough/Layoffs Special Rules

If an enrolled employee working 30 hours or more per week is furloughed or has hours reduced below 30 hours per week, Cigna will agree, at the groups formal request, to allow the employee to remain on the plan for the duration of the extended relief period as long as premium payments are made. “Extended relief period” is defined as the period starting on March 16, 2020 through August 31, 2020. This period may be extended by Cigna in response to evolving external events as well as Cigna’s financial capacity.

Premium Grace Periods

Groups in need of assistance should contact their CIGNA account manager to review.

IN-Network Diagnostic Testing for COVID-19

Member Cost-Share Waived

Maintenance Medications

No waiver at this time

Telemedicine

Telemedicine is available at the existing benefit level. Cigna has opened a 24-hour telephone HELP line, 866.912.1687, to allow you and your family members to speak with qualified clinicians about how to cope with anxiety, stress, or other issues related to the impact of the COVID-19.

Carrier Resources

https://www.cigna.com/individuals-families/health-wellness/topic-disaster-resource-center

COVID-19 Antibody Testing

FDA approved antibody testing is covered, and member cost-share will be waived.

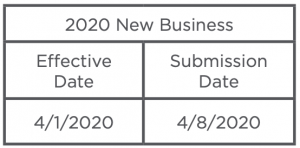

Small Group New Business Submission Extensions

April 1, 2020 new business submission deadline has been extended to April 8, 2020.

Exceptions

Emblem has opened a special enrollment period for employees who previously waived coverage. The effective date of coverage will be April 1, 2020; applications will be accepted through April 7, 2020. This SEP does not allow for currently enrolled employees to change plans. This opportunity is limited to employees and dependents that previously waived coverage.

Furlough/Layoffs Special Rules

Laid off or furloughed employees that were covered by the plan may remain on the plan until June 30, 2020 without electing COBRA or continuation under state law. The group must continue to pay the monthly premium payments, and employee premium contributions must be the same or less than they were prior to the layoffs or furlough. Coverage must be maintained on a uniform, non-discriminatory basis to all eligible laid off or furloughed employees. At least one employee must remain actively employed. Terminated employees should be offered state continuation/COBRA. Upon rehire, the wait period will be waived.

Premium Grace Periods

Employer groups suffering financial hardship may request a premium extension as mandated by NYS. The process is as follows:

March premium must be paid in full before a group can request the premium grace extension plan. If a group wants to take advantage of the premium grace period, the group, the broker or GA MUST CALL into EmblemHealth’s Broker Service Department at 1-866-614-6040 and advise they have a financial hardship to take advantage of this program.

April premium must be paid in full by 6/1. For May premium, groups will have until 6/1 to pay their premium in full.

If both premiums are not paid by 6/1, EmblemHealth will terminate the groups on 6/2 back to 3/31 (4/1/2020), and with the assistance of EmblemHealth’s Financial Recovery Team, EmblemHealth will pursue any paid claims.

IN-Network Diagnostic Testing for COVID-19

Member Cost-Share Waived

Maintenance Medications

Early refill of prescription is allowed. Members in need of an early refill for your prescription due to the COVID-19 outbreak, please tell your pharmacist to enter the following Submission Clarification Code (SCC): SCC 13. Some pharmacies are not familiar with this new code, so be sure to let yours know about it. If your early refill is rejected even after using this code, please ask your pharmacist to contact the Express Scripts Pharmacy Help Desk at 800-922-1557.

Telemedicine

Telemedicine is available at the normal cost-share.

Carrier Resources

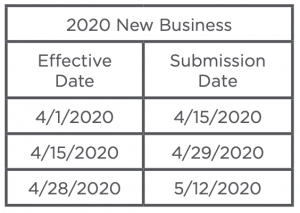

Small Group New Business Submission Extensions

Small Group 1-100, April 1, 2020 new business submission extended to April 8, 2020. Empire is also extending the small group 1-100 recredentialing deadline from 3/31/2020 to 4/8/2020.

Exceptions

Empire opened a Special Enrollment Period (SEP) from now until April 3, 2020 to make benefits available to employees in Fully-Insured Small and Large Groups who previously waived participation in employer-sponsored plans. State eligibility guidelines will apply. This SEP is in response to COVID-19. It’s another way Empire is helping people get the care they need. Who’s eligible? Employees who were eligible for benefits during employers’ Open Enrollment are eligible for this SEP if they had previously waived coverage. How it works: Employers will follow the standard process of sending updated enrollments to Empire, just as they would for any qualifying event or enrollment period, through their elected format of 834s, the EmployerAccess portal, or other approved methods.

Furlough/Layoffs Special Rules

Empire’s requirement for employees to be actively working in order to be eligible for coverage will be relaxed through July 31, 2020 as long as the monthly premium payment is received and at least one employee remains actively employed. Coverage must be offered on a uniform, nondiscriminatory basis to all employees and employee premium contributions must be the same or less than what they were prior to the layoffs. Employees who are terminated from employment should be offered state continuation/COBRA. Employees rehired prior to July 31, 2020 will not have to satisfy a new hire wait period.

Premium Grace Periods

Per a recent New York State insurance regulation, Insureds experiencing a financial hardship due to COVID-19 now have until June 1, 2020 to pay their health insurance premium. Please note, this does not mean the obligation to remit premium is waived or excused for this period. The regulation temporarily changes the grace period for Individual and Small Group fully-insured health insurance policyholders who experience financial hardship due to COVID-19. This applies to commercial Small Group and Individual subscribers except for APTC/subsidy recipients as well as full-payment Child Health Plus subscribers.

Groups must notify Empire that they are experiencing a financial hardship due to COVID-19 that makes it difficult to pay their premium on time, their grace period is extended. They will have until June 1, 2020 to pay premium that was due on March 1, April 1 and/or May 1. Small Group fully-insured policyholders who qualify under the provisions of the regulation are required to give Empire written attestation of hardship due to COVID-19 by sending notice of financial hardship to NYGracePeriod@empireblue.com.

IMPORTANT: The regulation requires insurers as well as agents to directly notify their health insurance policyholders in writing of the emergency regulation by April 21. You can send these notices to your Individual and Small Group clients with Empire coverage to fulfill that obligation.

Individual Letter:

Small Group Letter:

Diagnostic Testing for COVID-19

If a member or anyone on their health plan needs to be treated for COVID-19, Empire will cover the care with no copays or cost-sharing as long as they receive treatment from doctors, hospitals, and other healthcare professionals in their plan’s network for care received through December 31, 2020.

Maintenance Medications

Empire is relaxing early refill limits, where permitted. Empire is relaxing early prescription refill limits, where permitted, for members who have Empire pharmacy benefits and wish to refill a 30-day supply of most maintenance medications early. Additionally, members who have a pharmacy plan that includes a 90-day mail-order benefit should talk to their doctor about whether changing from a 30-day supply to a 90-day supply of their prescriptions is appropriate. Members filling 90-day prescriptions can get most of their medications through Empire’s home delivery pharmacy.

Telemedicine

Telehealth visits with healthcare providers in their plan’s network are covered at no cost to members through September 30, 2020. This includes visits that are not related to COVID-19.

The Virtual Care text feature on the Sydney Care mobile app allows members to chat with a doctor. Their first two text sessions are free through December 31, 2020. Additional text visits are $19 each.

Carrier Resources

Small Group New Business Submission Extensions

Not applicable at this time

Exceptions

Small Group Policies: Healthfirst is offering a Special Enrollment Period (SEP) to existing small group policyholders. For employees and dependents who previously waived coverage when they were first eligible, or for those who were still within their waiting period, the SEP provides the opportunity to enroll in benefits. Dependents such as spouses and children can be added to an existing account as long as they are enrolled in the same coverage or benefit option as the employee. Request for enrollment must be received no later than: April 5 for coverage effective April 1 and May 5 for coverage effective May 1.

Furlough/Layoffs Special Rules

Not applicable at this time

Premium Grace Periods

http://assets.healthfirst.org/pdf_e440eacac550af1c32a5e233ad063be2?v=0427123041

Businesses experiencing financial hardship due to the pandemic may request a premium grace period extension through June 1, 2020. This guidance only applies to April and May premiums. Healthfirst small groups can submit a request for a premium grace period extension to Employer Services by calling 1-855-949-3668 or by emailing EmployerandBrokerService@healthfirst.org. For your reference, your small group client(s) will receive this letter regarding the premium grace period extension. Premiums for both months will be due in full by June 1st or the group will be terminated.

IN-Network Diagnostic Testing for COVID-19

Member Cost-Share Waived

Maintenance Medications

One-time refill for 30-day supply of chronic medications

Telemedicine

Request a Teladoc visit by phone at 1-800-Teladoc (1-800-835-2362) or by visiting this https://member.teladoc.com/healthfirst

Carrier Resources

Small Group New Business Submission Extensions

Not applicable at this time

Exceptions

Annual MSP/MLR Collection Deadline Extension: Highmark Annual Group Client MSP/MLR Employee Count Collection Online Survey: The April 30, 2020 deadline to reply to this notice has been extended due to the ongoing COVID-19 crisis. If a client does not respond to the initial letter by the original deadline, they will receive a second letter, which will provide a new reply by date that will be flexible.

Furlough/Layoffs Special Rules

If an employee/member is laid off or furloughed prior to June 30, 2020, due to COVID-19 business disruption and rehired prior to June 30, 2021, Highmark will waive the waiting period for coverage. For coverage periods through June 1, 2020, we will waive “active at work” requirements for a period of up to 90 days. This enables coverage for employees/members transitioned to part-time or furlough status. The only requirements are that: a. the affected employees/members be currently covered on the plan, b. coverage be offered on a uniform, non-discriminatory basis, c. the premium is paid for the coverage with the same level of employer subsidies previously offered, and d. at least one employee/ member remains in active full-time employment.

Premium Grace Periods

Groups in need of assistance should contact their Highmark customer manager.

Testing & Treatment

Members receiving in-network hospital care for COVID-19 will not incur any out-of-pocket expenses (deductible, co-insurance, and copays). This waiver of member cost-share will remain in effect through May 31, 220. The waiver applies to all fully insured group, ACA and Medicare members. Self-Insured plans must opt-in to this program. The deadline to opt-in in 5pm, Friday April 10, 2020.

Maintenance Medications

No waiver at this time

Telemedicine

Telemedicine and virtual visits will waive cost-sharing and copayments for fully insured and ASO members under Teladoc, Amwell or Doctor on Demand for 90 days. ASO clients have option to opt out. Highmark has also expanded access to both in- and out-of-network teleaddiction services for members in Pennsylvania, West Virginia, and Delaware who are in addiction treatment and need immediate help without any out-of-pocket costs.

Carrier Resources

COVID-19 Antibody Testing

COVID-19 Antibody tests are covered in full, with no member liability, when ordered by a doctor or provider, including telemedicine providers and submitted through an in-network laboratory (CPT Codes: 86328 and 86769). These tests must be FDA approved and the office performing the test must have a Clinical Laboratory Improvement Amendments (CLIA) waiver certification to bill for these services.

Small Group New Business Submission Extensions

Exceptions

Small employer groups that currently offer a single plan option are eligible and allowed to downgrade to a

leaner plan design off anniversary through June 30, 2020.

Furlough/Layoffs Special Rules (Updated 5/14/20)

Horizon is waving the “actively at work” requirement applicable to fully-insured commercial plans. Furloughed employees or those with reduced work hours may remain covered under the group health plan provided medical premiums are paid. Furloughed employees may remain on the plan through June 30, 2020. Employees who are terminated should be offered State Continuation/COBRA. At the employer’s written request, rehire wait periods may be waived for employees temporarily terminated due to COVID-19 through August 31, 2020.

Premium Grace Periods

As detailed in Horizon BCBSNJ’s COVID-19 Resource Guide, per the New Jersey Department of Banking and Insurance (NJDOBI) Bulletin No. 20-13, Horizon BCBSNJ will extend the health and/or dental premium payment grace period for small employer and qualifying large employer (51+) customers.

Deadlines to elect the Emergency Premium Payment Deferral Program are as follows:

April 2020 – All forms must be submitted by 4:00PM on April 30th.

May 2020 – All forms must be submitted by 4:00PM on May 15th.

Small Employer: Horizon BCBSNJ will extend the health and/or dental premium payment grace period for small employer customers from 31 calendar days to 60 calendar days. The emergency grace period may start with either the April or the May coverage, and to the premiums due for those months covered by the emergency grace period. If the small employer group already missed the April premium payment, the group is currently covered under the emergency grace period.

1. Upon request for the group’s extension, brokers should send the Emergency Grace Period Premium

Deferral Program Agreement to the group for review and execution.

2. The executed agreement must be returned to your sales team at Savoy.

3. Savoy will file the request with Horizon BCBSNJ.

Repayment: If the small employer group takes advantage of the emergency grace period, the group will have six months to repay the deferred health and/or dental premiums in full.

Large Employer: Horizon BCBSNJ will extend the health and/or dental premium payment grace period for qualifying large employer customers to 60 calendar days. A large employer qualifies only if it can demonstrate financial hardship directly caused by COVID-19. The emergency grace period may be applied to the April or May premium.

1. Groups must formally request a grace period extension by having either a company official or the group’s CPA complete an Attestation addressed to Horizon BCBSNJ. The attestation should be sent to your Savoy Large Group Account Manager for submission to Horizon BCBSNJ.

2. Upon receipt of the attestation letter, your Horizon account manager will release a Emergency Grace Period Deferral Agreement for completion by the group.

3. Upon receipt of all required documentation, Horizon will send an executed agreement to the Group and/or Broker.

Repayment: If the large employer group (51+) takes advantage of the emergency grace period, the group will have at least six months to repay the deferred health and/or dental premiums in full.

As a reminder, to be eligible to participate in the Emergency Premium Grace Period Deferral Program, all groups, regardless of size, must be in good standing as of March 1, 2020.

Testing and Treatment

Effective immediately and through August 31, 2020, all fully-insured members, including those covered through Medicaid, Medicare Advantage, Individual and Small Group policies as well as members covered by the State Health Benefits Program (SHBP) and the School Employees’ Health Benefits Program (SEHBP), will not pay any cost-share amounts (copay, coinsurance, deductibles) for covered services related to the testing, diagnosis and treatment of COVID-19 for:

• All charges associated with a visit to an in-network or out-of-network primary care physician or urgent care center or Emergency Room (ER) for evaluation of symptoms identified as possible indicators of COVID-19 infection.

• All in-network and out-of-network labs for charges associated with the delivery of services connected to CDC-approved lab studies or tests for COVID-19 for members who know they have been exposed to an individual diagnosed with COVID-19 or with symptoms identified by the CDC as possible indicators of COVID-19 infection.

• All covered benefits associated with inpatient and outpatient care when delivered by in-network professionals and facilities, and when your claim indicates it related treatment to COVID-19.

Maintenance Medications

Waiving early refill limits on 30-day supply of maintenance medications expired June 30, 2020.

Telemedicine

Access to telehealth will be provided 24/7 and member cost share will be waived through June 13, 2020. In addition, 24/7 access to licensed nurses who can assess and assist members with symptoms that are consistent with suspected COVID-19 infection. Those service are available through the company’s free “Horizon Blue” app, the www.HorizonBlue.com online portal, or by phone at 1-888-624-3096

Carrier Resources

COVID-19 INITIATIVES ARE CURRENTLY IN EFFECT UNTIL 12/31/2020 UNLESS OTHERWISE NOTED

Below are Provisions for Fully-Insured Accounts and Members; Self-Funded provisions may differ, Please see

https://www.ibx.com/pdfs/custom/edge/covid-19-self-funded-chart.pdf for further details on Self-Funded.

COVID-19 Testing

The COVID-19 diagnostic test and Antibody test are covered with no member cost-sharing, when directed by the member’s health provider.

Waiving Cost Share

IBC is waiving member cost-sharing for in-network, inpatient acute care treatment associated with COVID-19 diagnoses.

Waiving Prior Authorization

Waiving prior authorization for all inpatient admissions and suspending prior authorization requirements for acute inpatient admissions from the emergency department at in-network facilities for plan members.

Facilities must notify the plan. In effect through July 31, 2020. Waiving prior authorization requirements for post-acute care admissions and suspending prior authorization requirements for transfers from acute in-network, inpatient facilities to in-network, post-acute facilities (long-term acute care, rehabilitation, and skilled nursing facilities) for any diagnoses. Includes in-network transportation prior authorization requirements from acute inpatient facilities to subacute facilities. Facilities must notify the plan. In effect through July 31, 2020.

Furloughed Employees

Provision: IBC will honor employer requests to continue coverage for employees furloughed or temporarily laid off as a result of impacts of COVID-19, as long as premium payments continue to be made by the employer. In effect through September 30, 2020.

Consumer-grade pulse oximeters are covered for members who have a COVID-19 diagnosis, recovering from COVID-19 after being hospitalized, or a patient with respiratory symptoms while waiting for COVID-19 test results, at no member cost share. Prescribed by a health professional. In effect through July 31, 2020.

Wellness Credits: For any group that had wellness credits expiring during the pandemic months, they may be used through December 31, 2020.

Testing & Treatment

IBC is waving member cost share for in-network, inpatient, acute care treatment of COVID-19. This means members will have no out-of-pocket costs for COVID-19 related hospitalizations, and for emergency room visits that result in a member being admitted for COVID-19 treatment. These changes are being extended through June 30, 2020.

Maintenance Medications

Waiving early refill limits on 30-day supply of maintenance medications

Telemedicine

Telemedicine – MDLive® visits cost sharing is waived for all MDLive telemedicine visits. Telemedicine – Primary care (PCP) cost sharing is waived for all telemedicine visits with plan members’ existing PCPs. Telemedicine – regular cost sharing applies for Specialists. Covers telehealth appointments for: specialists; nutrition counseling; and urgent care and video-only visits for physical, occupational, and speech therapy. Telemedicine – Behavioral Health In place, business as usual. Based on benefit design, covers in-network, out-of-area, and out-of-network telemedicine with behavioral health professionals at regular cost sharing.

Carrier Resources

COVID-19 Antibody Testing

FDA approved antibody detection tests for COVID-19 will be covered at no cost-share to the member when ordered by a physician or other healthcare provider.

Small Group New Business Submission Extensions

Not applicable at this time

Exceptions

Not applicable at this time

Furlough/Layoffs Special Rules

SPD allows for extended coverage to furloughed employees. Contact your Sales Team for additional details.

Premium Grace Periods

In an effort to assist our employers during this unprecedented time, we will address all requests for additional grace period on a case-by-case basis. Employer groups should call the billing team at 833-639-2669, option 5.

IN-Network Diagnostic Testing for COVID-19

Member Cost-Share Waived

Maintenance Medications

No waiver at this time

Telemedicine

Member cost-share waived, through 6/6/2020

Carrier Resources

Small Group New Business Submission Extensions

Not applicable at this time

Exceptions

Oscar is extending prior authorizations for any previously approved request to 180 days (from 60 days). For Durable Medical Equipment, the extension is to 90 days (from 30 days).

Furlough/Layoffs Special Rules

Not applicable at this time

Premium Grace Periods

NJ Premium Grace Periods:

• Extended time to pay premium for all of your Individual Clients.

For on-exchange subsidized clients who were in good standing as of 3/1/20 (paid through March), and who have already paid binder in full, Oscar is providing an extended grace period of 120 days. This would begin 4/1/20 or 5/1/20, based on your client’s missed payment date. For your unsubsidized clients in good standing as of 3/1/20, Oscar has extended the current 31-day grace period to 60 days.

• Flexible grace period payment for your Unsubsidized Individual Clients.

Clients who are unsubsidized (on or off exchange, receiving no subsidy) who take advantage of the grace period will have the option to pay unpaid premium in installments, instead of in full. For example, if six months remain on the policy after the grace period and your client has $300 in unpaid premium, they can pay their standard monthly premium plus $50 each month to be paid in full by the end of year. Please have members call their Concierge team at 855-672-2755 to set up a payment plan.

• Extended grace period duration for all of your Small Group Clients.

Small groups in good standing as of 3/1/20 are eligible for an emergency 60-day grace period. The grace period may be applied towards the April or May premium and will continue for 60 calendar days from that date. Note that all NJ small groups with anniversary dates between March through the end of NJ’s emergency order will be eligible for renewal, subject to applicable federal and state law.

• Flexible grace period payment for all of your Small Group Clients.

Oscar is providing a payment plan so that any unpaid premium can be paid in installments. For example, if six months are remaining on the policy, the group will have the option to pay the unpaid premium in six installments in addition to the regular monthly premium through the end of year, same as individual clients (for small groups with less than three months remaining on the policy, Oscar will allow for six months for the deferred premium to be paid). Please have groups call 1-855-672-2784 to set up a payment plan.

NY Premium Grace Periods:

• Extended grace period for Individual and Family Plans.

The grace period has been extended for an additional 30 days, meaning that your subsidized Individual and Family Plan clients now have an extended period where their claims will be paid before termination. Oscar will continue paying claims for the first 60 days of this period. This only applies to Individual and Family Plan subsidized members who entered the grace period as of April 1st (i.e., client was fully paid as of March). Those who entered prior to that date will be held to regular grace period conditions.

• Future eligibility for Individual and Family Plans.

Clients who do not pay all premiums in full during the entire 120-day period will not be eligible to re-enroll in a QHP unless they have an existing QLE.

• Documentation requirements for subsidized individuals.

While Oscar is not requiring proof of COVID-19 financial hardship for premium payment and grace period flexibilities for subsidized on-exchange individuals, everyone seeking to extend their grace period must call Concierge and request to do so.

• Extended grace period for small groups and non-subsidized individuals.

For clients who are fully paid as of March and can demonstrate financial hardship as a result of COVID-19, the grace period will be extended to 11:59PM on June 1, 2020 or the expiration of the applicable contractual grace period, whichever is later. Oscar will continue paying claims during this period.

Testing & Treatment of COVID-19

Member Cost-Share Waived

Maintenance Medications

Waiving early refill limits on most prescription drugs.

Telemedicine

Member Cost-Share Waived.

Carrier Resources

COVID-19 Antibody Testing

For the duration of the emergency period, UnitedHealthcare will cover antibody detection tests (Serology – IGG/IGM/IGA for SARS-nCOV2 (COVID19) at no cost-share to the member when ordered by a physician or health care provider.

UnitedHealthcare strongly supports the need for reliable testing and encourages employers and members to consider tests that either have FDA approval or an emergency use authorization from the FDA.

Small Group New Business Submission Extensions

Exceptions

UHC is providing fully-insured Small Business and Key Accounts clients with a Special COVID-19 Enrollment Opportunity to enroll employees who did not previously enroll in coverage. The opportunity will allow employees who previously did not elect coverage for themselves (spouses, children) or waived coverage to enroll. The opportunity will extend from March 23 to April 13, 2020. The effective date of coverage will be April 1, 2020. Buy down to a leaner plan, employers have options to downgrade current plan design or add a leaner plan option. Please discuss available options with your Savoy sales team. Plan buy downs and additions to leaner plan design options are available through May 31, 2020.

Furlough/Layoffs Special Rules

Furloughed employees and those with reduction in hours will be temporarily allowed to stay on the medical plan premium provided payment continues and that the option to remain insured is offered to all impacted employees. Employees who are laid-off, should be terminated from the group health plan and offered State Continuation/COBRA. Upon rehire, wait period will be waived.

Premium Grace Periods

For insureds (individual /group) who are experiencing financial hardship as a result of COVID-19 and need assistance, please contact Oxford using the following instructions:

For Groups (small and large) that are experiencing financial hardship as a result of COVID-19 and need assistance, they can request an extension or discuss alternative payment arrangements by calling Oxford Financial Operations team at 1-800-366-4148, TTY 71.

Individual insureds must confirm their intent for an extension of premium payment(s), to do so, please send an email to billing_team@uhc.com with one of the following three responses:

• I hereby attest that I am experiencing financial hardship related to COVID-19 and would like to request a premium payment extension until <insert date>. I understand by doing so that I am contractually committed to pay premium at least through this date.

• I would like to remain on my current premium payment cycle.

• My intention is to have my current coverage lapse. or Policyholder Name, Policy Number, Requested Termination Date, Reason for Termination

Please note that this is simply an extension to pay premium for those in need and not a waiver or forgiveness of the premium.

In-Network Diagnostic Testing & Treatment for COVID-19

Member Cost-Share waived for testing and treatment related to COVID-19 through July 24, 2020.

Maintenance Medications

Waiving early refill limits on 30-day supply of maintenance medications through June 15, 2020.

Telemedicine

Telemedicine is available at no cost for COVID-19 related systems through July 24th and for non-COVID-19 services through June 18th. For groups enrolled on the Oxford platform, members should contact member services to request an online access code for telemedicine services.

Carrier Resources

https://www.uhc.com/health-and-wellness/health-topics/covid-19

Executive Order #123

On April 9th, Governor Phil Murphy signed Executive Order No. 123, extending grace periods during which certain insurance companies, including health insurers, life insurers, and property and casualty insurers, cannot cancel policies for nonpayment of premiums.

As part of its passing, the following are being put in place:

- Extends minimum grace periods: A minimum 60-day grace period will be required for health and dental insurance policies, and a minimum 90-day grace period will be required for life insurance, insurance premium-financing arrangements, and property and casualty insurance, which includes auto, homeowners, and renters insurance. Insurance companies will be required to notify policyholders of this emergency grace period and to waive certain late fees, interest, or other charges associated with delays in premium payments as directed by the Commissioner of Banking and Insurance. Insurers will also be required to provide each policyholder with an easily readable written description of the terms of the extended grace period. The extended grace periods will not apply to employer-funded health plans, which under federal law, are regulated exclusively by the federal government.

- Requires insurance companies to pay claims during the grace period: Insurance companies will be required to pay any claim incurred during the emergency grace period that would be covered under the policy. The Order further prohibits insurance companies from seeking recoupment of any claims paid during the emergency grace period based on non-payment of premiums.

- Ensures that unpaid premiums are made payable over a lengthy period: To ensure that policyholders are not required to make a lump sum payment on unpaid premiums at the end of the grace period, any unpaid premium will be amortized over the remainder of the policy term or a period of up to 12 months, as appropriate and as directed by the Commissioner of Banking and Insurance.

(Published by NJ.gov on 4/9/2020)

Layoff vs. Furlough

What is the difference between layoff and furlough?

Generally, when the employer is furloughing employees this is a situation where the employer/employee relationship is not severed. Conversely, when the employer is laying off employees, the employment relationship is terminated.

Under a layoff, will I lose health benefits?

Under a layoff, the employment relationship is terminated therefore the employee loses eligibility under the plan. This is a COBRA triggering event for the health benefits (medical, dental, vision, health FSA, etc.) Loss of eligibility is also a qualifying special enrollment event for the individual market.

If COBRA is elected and the person does not enroll in individual coverage, they cannot do so until the next annual open enrollment for the marketplace.

If I am laid-off, can I enroll in an individual plan instead of COBRA?

Yes. Loss of eligibility is also a qualifying special enrollment event for the individual market.

If COBRA is elected and the person does not enroll in individual coverage, they cannot do so until the next annual open enrollment for the marketplace. You are “stuck” with COBRA, for the remainder of the COBRA period, until the next annual marketplace open enrollment or until you become eligible for new group health plan.

IMPORTANT: The employer should clearly advise that an individual who elects COBRA will have to exhaust it before becoming eligible for Individual coverage and will in essence be “stuck” until COBRA runs out or the next Open Enrollment. That means they also cannot apply for a subsidy until the next Federal Open Enrollment. An individual obtaining a subsidy will not harm the employer if the individual is not working.

If I enroll in an individual plan, can I receive a subsidy to help pay for the cost of the plan?

In order to qualify for a subsidy (premium tax credit) there are certain criteria you must meet; most notable is subsidy eligibility is based on income.

Who pays for COBRA coverage?

The employee generally pays the full cost of the insurance premiums. The law allows the employer (COBRA administrator) to charge up to 102 percent of the premium to cover administrative costs.

Employers can choose but are not required to subsidize COBRA for terminated employees.

Under furlough, will I lose health benefits?

All eligible employees are still entitled to benefits while on furlough. If eligibility for health care benefits is maintained during a furlough, the employer can collect the employee’s share of premium to maintain the coverage during a paid or unpaid leave of absence.

How do I pay my employee contribution if I am on furlough?

Premiums may be collected (as determined by the employer’s policy) in one of the following manners:

- Catch up. Some employers choose to keep employees on leave enrolled in their benefits until they return to active work, and then recoup those payments at the time the employees return to work. If there is a fairly large premium payment due at the time the employees return to work following the leave, it may be necessary for the employer to take deductions over several payroll periods. In some cases, state wage and hour laws will limit the amount that can be deducted from pay (thus the cap may be necessary).

- Pre-pay. If the leave is scheduled in advance, and the employee remains eligible for benefits during the leave, the employer may collect the employee’s share of premium for the rest of the plan year from the employee’s pre-tax earnings before the start of the leave. However, if the leave is anticipated to span more than one plan year, then the employer cannot collect the premiums for the latter part of the leave since this would violate the cafeteria plan regulations prohibiting deferred compensation.

- Pay-as-you-go. During the leave, the employer may require the employee to pay the employee’s portion of the premiums to maintain coverage. Such payments would generally be on an after-tax basis, by remitting payment to the employer, and the employer could require payment no more frequently than regular deduction frequencies for employees during periods of active work. Most employers collect premiums from employees on leave of absence on a monthly basis.

In cases where there is paid leave, the employer may collect those premiums through salary reductions under the cafeteria plan. However, for periods of unpaid leave, where the “pay as you go” method for collection is utilized, the employee would remit those amounts to the employer on a post-tax basis.

Families First Coronavirus Response Act

I heard that the new Act includes tax credits. For what size employers does this apply and what is the credit?

First, most importantly, be sure to familiarize yourself with the requirements under the Families First Coronavirus Response Act provisions. You can do so by referring to the chart we have made available in the COVID-19 Resources. Affected employers are employers with 1–499 employees.

Specifically addressing the tax credit, The U.S. Treasury Department, Internal Revenue Service (IRS), and the U.S. Department of Labor (Labor) announced in a News Release on March 20th, that small and midsize employers can begin taking advantage of two new refundable payroll tax credits, designed to immediately and fully reimburse them, dollar-for-dollar, for the cost of providing Coronavirus-related leave to their employees.

Eligible employers will be able to claim these credits based on qualifying leave they provide between the effective date, April 2nd and December 31, 2020. Equivalent credits are available to self-employed individuals based on similar circumstances.

The chart goes into detail about the credit for Paid Sick leave. Note: Eligible Employers receive 100% reimbursement for paid leave pursuant to the Act.

Health insurance costs are also included in the credit.

Employers face no payroll tax liability. And Self-employed individuals receive an equivalent credit.

The next logical question is how quickly will the employer be reimbursed?

If there are not sufficient payroll taxes to cover the cost of qualified sick and childcare leave paid, the IRS Notice released on 3/20 addresses Prompt Payment for the Cost of Providing Leave.

When employers pay their employees, they are required to withhold from their employees’ paychecks federal income taxes and the employees’ share of Social Security and Medicare taxes. The employers then are required to deposit these federal taxes, along with their share of Social Security and Medicare taxes, with the IRS and file quarterly payroll tax returns on Form 941 with the IRS.

Under guidance that will be released later this week, eligible employers who pay qualifying sick or childcare leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and childcare leave that they paid, rather than deposit them with the IRS.

If there are not sufficient payroll taxes to cover the cost of qualified sick and childcare leave paid, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less. The details of this new, expedited procedure are expected to be announced this week.